Rental income can play a significant role in increasing your mortgage borrowing power. However, how it’s treated depends on the policies of your lender.

Understanding these policies and how they impact your Total Debt Servicing Ratio (TDSR) can help you plan better and improve your chances of mortgage approval.

What Is TDSR and Why Does It Matter?

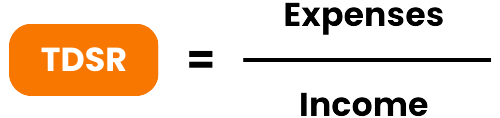

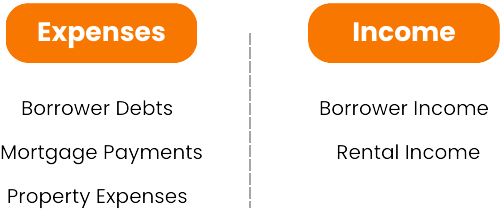

TDSR, or Total Debt Servicing Ratio, is a calculation lenders use to determine if you can afford a mortgage. It’s expressed as a percentage and compares your total monthly debt payments to your gross monthly income. The formula is:

Total Debt Payments include your mortgage payment, property taxes, credit card payments, car loans, and any other monthly debt obligations. Gross Income includes all income sources, such as your salary, bonuses, and rental income (if applicable). Most lenders in Canada require your TDSR to be below 40–44% to approve a loan.

How Lenders Treat Rental Income in Canada

Rental income is often included in the TDSR calculation, but how it’s treated depends on the lender.

The two most common methods are the Add to Income policy and the Rental Offset policy. Each method impacts your TDSR differently.

The Add to Income Policy Explained

With the Add to Income policy, a percentage of your rental income is added to your gross income. This increases your income side of the TDSR calculation, making it easier to qualify for a mortgage.

Example:

- Monthly rental income: $3,000

- Let’s say Lender A uses an “80% add to income”

Rental Income Added to Gross Income = $3,000 × 80% = $2,400

The $2,400 is added to your gross income, boosting your borrowing power. Property expenses, like the mortgage payment and property taxes, are still included in the debt side of the TDSR calculation.

How the Rental Offset Policy Works

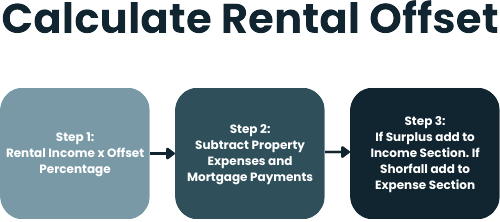

The Rental Offset policy is slightly more complex.

With this method, lenders calculate the net rental income by considering both the rental income and the property’s expenses.

- Multiply the rental income by the offset percentage (e.g., 80%).

- Subtract the property’s expenses (mortgage payment, property taxes, etc.) from this amount.

- If the result is negative (a shortfall), it’s added to the debt side of the TDSR formula as a property expense. If the result is positive, some lenders may ignore the property, while others add the positive amount to your gross income.

Example:

- Monthly rental income: $3,000

- Offset rate: 80%

- Monthly mortgage payment: $3,500

- Monthly property taxes: $200

Net Rental Income = ($3,000 × 80%) – ($3,500 + $200)

Net Rental Income = $2,400 – $3,700

Net Rental Income = -$1,300

In this case, the $1,300 shortfall is added to the debt side of the TDSR formula as a property expense.

Key Differences Between Add to Income and Rental Offset

Add to Income: Adds a percentage of rental income to your gross income. Expenses are calculated separately as part of your total debt payments.

Rental Offset: Subtracts expenses from a percentage of the rental income to calculate net rental income, which is then applied to the TDSR formula.

Each method has its pros and cons, and the one used can significantly impact your borrowing power.

Step-by-Step Example of TDSR With Rental Income

Meet Sarah, a professional in her early 40s, who has decided to buy a new home for herself and her family. This home comes with a rental suite, which she hopes will generate extra income to help offset her monthly expenses. Sarah has a stable annual income of $150,000, which gives her $12,500 per month to work with.

Currently, Sarah owns a non-subject property where she pays $2,500 a month for her mortgage, $291.67 for property taxes, and $115 for heating. This property generates $2,650 in rental income each month.

The new home Sarah is looking to buy would need a $700,000 mortgage. The lender currently has an interest rate of 4.44%. This means her monthly mortgage payment on the new property would be $3,867.03. In addition, she’ll need to budget $375 per month for property taxes and $115 for heating.

The home’s rental suite is expected to bring in $1,100 per month in rental income, which Sarah sees as a fantastic way to help manage her monthly housing costs. She’s confident that with her steady income, careful budgeting, and the rental suite, she’ll be able to comfortably manage both properties while working toward her long-term financial goals.

Borrower Information:

- Borrower’s total annual income: $150,000 ($12,500 per month)

- Monthly non-subject property rental income: $2,650

- Monthly non-subject property monthly expenses: $2,500 (mortgage) + $291.67 (property taxes) + $115 (heat)

- Subject property mortgage request: $700,000

- Monthly subject property rental income: $1,100

- Subject property monthly expenses: $375 (property taxes) + $115 (heat)

Lender Information:

Let’s say the lender has the following information in their policy:

- Non-subject property rental policy: “100% rental offset with a 15% vacancy rate”

- Subject Property rental policy: “80% add to income“

- The lender is currently offering 4.44% for this mortgage at a 25 year amortization

For the non-subject property, Sarah receives $2,650 in monthly rental income but the lender must account for a 15% vacancy rate:

Eligible Rental Income = $2,650 × (1 – 15%) = $2,252.50

The monthly expenses for the non-subject property are:

- Mortgage payment: $2,500

- Property taxes: $291.67

- Heat: $115

Net Rental Income = $2,252.50 – ($2,500 + $291.67 + $115) = -$362.50

Since the net rental income is negative, the $362.50 shortfall is added to the debt side of the TDSR calculation.

The purchase price of Sarah’s new home is $700,000. At an interest rate of 4.44%, her actual monthly mortgage payment would be approximately $3,867.03, based on a 25-year amortization (300 months). However, lenders in Canada apply a “stress test” to ensure borrowers like Sarah can still afford their mortgage if interest rates rise in the future.

The stress test uses the higher of two rates:

- The current interest rate plus 2%

- The Bank of Canada’s qualifying rate

In Sarah’s case:

- Actual interest rate: 4.44%

- Stress-tested rate: 4.44% + 2% = 6.44%

Using the stress-tested rate of 6.44%, her monthly mortgage payment is recalculated to $4,700.24. This higher amount is used by the lender to evaluate Sarah’s Total Debt Servicing Ratio (TDSR), ensuring she can handle potential rate increases over the mortgage term. Although her actual payments would be lower, the stress test gives the lender confidence that Sarah can manage her financial obligations even in a worst-case scenario.

Debt payments include the following:

- Non-subject property rental shortfall: $362.50

- Subject property mortgage payment: $4,700.24

- Subject property property taxes: $375

- Subject property heat: $115

Total Debt Payments = $362.50 + $4,700.24 + $375 + $115 = $5,552.74

Gross income includes:

- Borrower’s monthly income: $12,500

- Subject property eligible rental income: $880

Gross Income = $12,500 + $880 = $13,380

TDSR = (Total Debt Payments ÷ Gross Income) × 100

TDSR = ($5,552.74 ÷ $13,380) × 100 = 41.5%

With this updated calculation, Sarah’s TDSR comes in at 41.5%, which falls within the typical 40–44% range that many lenders consider acceptable. This makes her a strong candidate for the mortgage.

How to Maximize Your Borrowing Power with Rental Income

If you want to borrow more for your next home, picking the right lender is super important.

Every lender looks at rental income differently, and this can change how much they’re willing to lend you. Some lenders will add a part of your rental income to your total income, while others will subtract your property expenses first. This means you might qualify for very different amounts depending on the lender.

Figuring this out on your own can be tricky. You’d have to shop around, send your documents to a bunch of lenders, and keep track of all the submissions.

But there’s an easier way. A mortgage broker can handle everything for you. You only need to submit your documents once, and they’ll match you with the lender that’s the best fit for your needs.

A broker knows the rules and policies for each lender, so they can save you time and effort while making sure you get the best deal.