(All While Pulling Out an Extra $25,000 for a Future Rental Purchase)

Disclaimer: Any Case Study or Example is Based on a Real Client that I’ve Worked With. Any Information That Could Be Used to Identify Them Has Been Changed.

Disclaimer: The names and information in this post about debt consolidation are adjusted for privacy purposes.

John Barnes was facing some big financial challenges.

He owned a home and had a steady job, but he also had several debts—credit cards, a car loan, and a line of credit.

He wanted to buy a new condo soon, but his monthly payments were just too high. So, he needed a plan to make things easier.

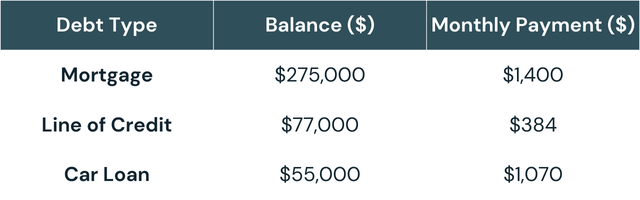

The Situation Before Consolidating his Debt

John’s home was worth around $700,000, and he had a mortgage with a balance of $275,000. His mortgage payments were $700 per month.

He also had a line of credit with a balance of $77,000 where some of it was used for a deposit on his new condo. The payments on this line of credit before consolidating were $384 pre month. On top of that, he had a car loan with monthly payments of $1,070.

The Solution: Debt Consolidation

John decided to refinance his mortgage.

This allowed him to combine all his debts into one, so he only had one payment each month.

He increased his mortgage to $500,000, which was just 70% of his home’s value.

By doing this, John could pay off his current mortgage, his line of credit, and the car loan all at once. This process is called debt consolidation, and it’s a smart way to lower monthly payments.

The Costs

Refinancing wasn’t free, but the costs were manageable. Here’s what John had to pay:

- Mortgage penalty: $3,500

- Legal fees: $1,250

- Appraisal fee: $350

After paying these costs and all his debts, John had around $25,587 left over for his future condo.

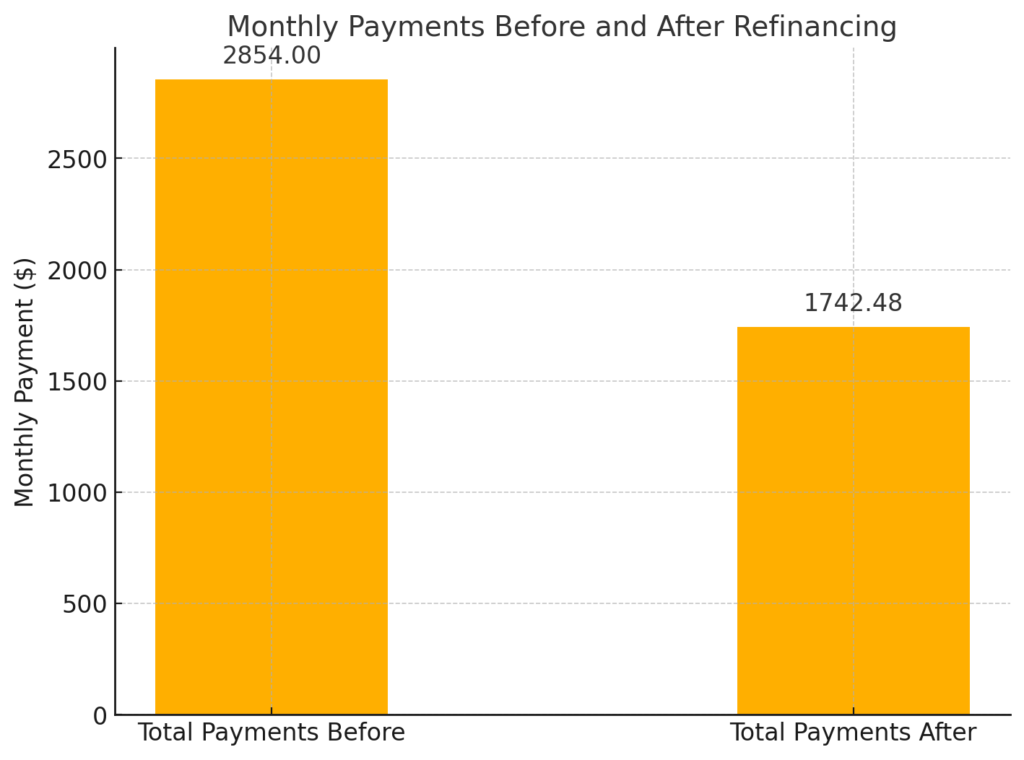

Monthly Payment Comparison

Before Debt Consolidation:

- Mortgage: $1,400/month

- Car Loan: $1,070/month

- Line of Credit: $384/month

- Total: $2,854/month

After Debt Consolidation:

- New Mortgage Payment: $1,742.48/month

By refinancing, John saved $1,111.52 each month! That’s over $13,000 a year.

The Benefits of Debt Consolidation

John’s story shows how refinancing your home can help:

- Lower monthly payments

- Combine multiple debts into one payment

- Save money each month that you can use for other things

If you’re struggling with your monthly payments or want to know how debt consolidation can help you, let’s chat.

Ready to Save on Your Monthly Payments?

If you’re a homeowner and you’re tired of juggling payments, let’s make a plan that works for you. Schedule a strategy session with me today, and I’ll show you how we can lower your payments and free up your finances.