Have you heard of the BRRRR strategy and thought it was too good to be true?

Never heard of it at all and wondering why I’m freezing?

Not sure what all of the steps and pitfalls are in the strategy?

This guide is for you.

If I were to sum up why the BRRRR strategy is amazing… it’s because you are effectively recycling the invested capital.

You use capital in the investment, and then the investment gives it back to you.

Amazing!

Too good to be true right?!

Well… not really, it’s actually made a lot of millionaires in the real estate investing space BUT there are some key things to be aware of… You have to:

- Be extra diligent when searching for properties

- Understand the market you’re investing in

- Plan the financing around the strategy

- Know the risks and plan for the worst

And that’s what I’m going to go over today in this video!

This is, the complete BRRRR Strategy guide – from a mortgage broker’s perspective!

First off, what is the BRRRR Strategy?

There are 5 steps or stages in the BRRRR Strategy:

- Buy

- Renovate

- Refinance

- Rent

- Repeat

The 5 Stages of the BRRRR Strategy

Phase 1: Buying the Property for your BRRRR Investment

You first need to find an ideal BRRRR property. This can be a challenge in itself – ESPECIALLY in Canada.

The central tenant around this strategy is to find a property that you can use sweat equity to raise the property value.

Property prices in the GVA and GTA are mostly determined by their land value. Since you can’t increase land value, the majority of their value is not something that you can change. It changes due to the appreciation of the land itself.

Note: in other forms of investing this is the difference between Alpha and Beta.

Beta is the market return. It’s what the market is going to do regardless of the investment manager.

Alpha on the other hand is the return associated with decisions and actions that the investment manager takes.

Phase 2: Renovating the property to increase its value

The next stage of this process is the key – the renovation.

The best case scenario is that you can increase the property value enough that you can pull out all of your original investment capital and more during the next stage.

Phase 3: Refinance your property to pull out the created equity

Once the renovation is complete, you’ll need to refinance to pull out the new equity. There are some key factors here which I go over in the financing section.

Phase 4: Rent out the property and manage it

Okay! The property is set up and refinanced.

You can now rent out the property.

By renting it out, you get to hold onto the property and enjoy long term appreciation and cash flow.

Ideally, this process would have gotten you a “free” investment property.

Phase 5: Repeat and scale [optional]

Lastly, if all went according to plan, you have the capital back AND experience. Rinse and Repeat!

Quick Example of a BRRRR Investment

Let’s say you found a distressed property in New Brunswick and you think you can use the BRRRR.

The purchase price is $500,000. You run the numbers and think that you should be able to renovate the property for $50,000 and increase the property value. You get a conventional 80% loan to value mortgage ($400,000).

This means you need to put in $150,000 cash.

To be able to pull all of the funds out, you would need to raise the property value to $687,500. The new mortgage would be $550,000.

Once it’s refinanced, you can rent it out for $2,700 per moth!

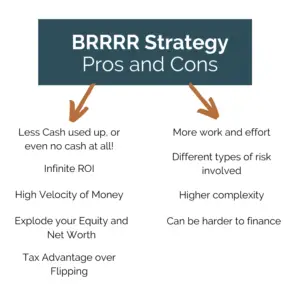

Advantages of the BRRRR Strategy over Traditional Buy and Hold

Let’s break down the main benefits of the BRRRR strategy:

Less Cash used up, or even no cash at all!

This is the main benefit of the strategy.

By utilizing it, you would be getting the cash back from the investment.

If you find investment partners or hard money lenders, you could even get this done by putting almost zero cash in.

Infinite ROI – Wait, let me explain…

ROI means return on investment.

Because you are getting your investment capital back from the investment your investment capital is zero.

What happens when you divide a number by 0? Well, that fraction goes to infinity!

High Velocity of Money

With the ability to get your funds back after the renovation, you don’t have to wait until you sell the property to get it back. With the funds back in hand, you can turn your capital over into a new investment faster.

Your funds can now be utilized on more projects, faster.

High Growth of your Equity and Net Worth

With a buy and hold property you make money in 3 ways:

- Cash flow

- Market appreciation

- Mortgage pay down

With this, you add an additional way:

- Forced Appreciation

This squeezes your net worth higher with every deal. You’re adding a new way of creating wealth by using a more active investment strategy.

Tax Advantage over Flipping

There’s a lot of people who decide to flip properties because the massive pay out if done right.

Here’s the thing, you have to pay taxes on the capital gains.

When you refinance, there is no taxes paid on funds taken out. The capital gains tax that you pay when you sell the property is deferred because you aren’t selling.

This means you are flipping the property but… to yourself. That’s why it’s commonly known as the “Flip to yourself” strategy.

Disadvantages of the BRRRR Strategy compared to Traditional Buy and Hold

There’s always a down side. Don’t let anyone tell you otherwise!

Here are some of the toughest parts that you need to know about:

More work and effort

This is an active investment strategy. In my personal opinion it’s closer to a business venture than it is to investing.

That’s because you are operating:

- A construction renovation

- Market research

- Raising capital and financing a project

- Managing the investment

That’s a lot!

BRRRR is not for everyone, but it can be very lucrative.

Different types of risk involved

There are different risks involved that the Traditional Buy and Hold.

These risks arise largely because we are operating a business. There are more moving parts.

Just like with a machine, the more moving parts there are, the more that has to be fixed and maintained.

More complex

As just mentioned, the BRRRR has more steps involved.

There are more times in the process that you need to be involved.

There are more times in the process that something needs to be maintained

There are more times in the process that something breaks.

This is part of the game and one of the reasons it can create way more wealth!

Can be harder to finance

This is the part that no one talks about publicly,

Why?

Because it’s bad for marketing.

The truth is, the BRRRR Strategy has quite a few challenges when it comes to financing. I get into the weeds as to why AND how to get around these challenges later.

BRRRR Strategies Advantages and Disadvantages Overview

Biggest Challenges with doing the BRRRR Strategy (In Practice)

With the pros and cons in mind, here are the top 4 things you need to keep in mind when considering the BRRRR strategy for yourself:

Financing

Financing these are difficult. Talk to a finance expert to make sure you know your plan in advance.

I’ve seen too often people get stuck mid process or find out that they can’t get exit financing because they didn’t talk to their broker or banker about their plan first.

Any good realtor, mortgage broker, RE investor will tell you: get pre approved before you do anything. It’s really that important.

Shameless plug: schedule a time with me. I’ve helped many clients build their portfolio with this strategy. You can book a time here:

Appraisal Risk

Another big challenge is that after the renovation is the appraised value.

Lenders will need to have the property appraised.

The maximum Loan to Value (% of the property value that the lender will lend up to) is based on this number.

If it comes in low, you may not get all of your funds back.

You may need to “season” the investment

This is a huge one that has to do with why financing is challenging.

Most lenders in Canada don’t want to refinance based on the appraisal value within 1 year of purchasing.

You may have to season the property, or hold it, for over a year before the refinance phase.

Rehab Risks

The renovation is the main part of the BRRRR strategy.

There are risks involved with flipping property.

Construction risks, running out of money, labour risks, market pricing risks.

The biggest tip I could give is to have a large cash buffer JUST IN CASE.

Construction projects have an ability to go sideways, quick.

Don’t let this deter you though! Risks and Effort are the key tenants to making money. You are bringing value into the world and that’s how business and investors get paid.

So… How do you Finance a BRRRR Investment Property?

Ahhh financing.

This is my home.

This is where I’ve spent my last 3 years focusing all of my time.

Weekly I have clients telling me they want to use this strategy to invest. Almost every time we end up talking about how financing is harder than advertised. But, that’s why we get referred to from their real estate coaches and realtors! We get it done.

Here’s how the financing works (in reality)

Stage 1: Financing the Purchase of the Property

The property gets financed twice.

Once during the purchase.

Again when you refinance.

There are the multiple different ways to finance the purchase and renovation:

Cash

This is the most straight forward way to finance the purchase of your BRRRR Investment property. If you have enough cash, you could just buy the property outright and fund the renovation.

This has the lowest risk because there’s no debt.

But here’s why it might not be the optimal direction:

- Slower velocity of money

- You could use the cash and OPM (Other people’s money) to fund a bigger project

- You could use the cash and OPM (Other people’s money) to fund multiple projects – this will diversify your risks

Most people will use some cash in the project.

Savings are the most natural way to invest.

HELOC

A HELOC on another property is another great source that a lot of investors use.

By using equity in another property, you increase that asset’s ROE (Return on Equity). Infact, you should be able to write off the interest of the HELOC because it’s being used to invest in real estate. (Always talk to your accountant about this!)

Conventional Mortgage

Getting a conventional mortgage has it’s challenges.

But here is where you get the best pricing on borrowed money.

Conventional mortgages have the best interest rates on market.

Often they have a box you need to fit in, which is where the challenges come up.

Hard Money or Private Lender

Most real estate investors end up here at some point.

The fact is, hard money and private money is easier to come by.

It’s more expensive, but there’s less strings attached.

Some of these lenders have really good construction programs. If you are doing a larger project, you can get some of the funds back during the project.

They also typically don’t care about your income, they just want to know they’ll get paid.

Joint Venture Partner (Cash Partner)

Lastly, partnerships.

Partnering is a great way to fill your missing gaps.

There are 3 types of partners:

- Cash partner

- Financing partner

- Working partner

You likely want to find a cash partner or financing partner for this stage.

One note I’d like to make though is it can be very helpful to find a working partner who’s done the BRRRR before. You lose some equity BUT you gain a ton in experience.

Stage 2: Financing the new mortgage on the property

Okay, so this is the part I promised.

This is, in my opinion, the most often missed part of the conversation.

Getting the refinance of the property can be a challenge and you need to be prepared for it.

The main challenges are:

- Most lenders want to see you own the property for over a year before they’ll use the appraised value of the property

- Debt servicing – conventional residential lenders will need you to qualify

- Number of property guidelines – most conventional residential lenders have a limit on number of properties and mortgages you can have. This part is key to planning out a medium and large portfolio. (Anything over 5 properties)

- Cash flow – what are the EXIT mortgage payments? Will that income cover the expenses plus this new mortgage?

- Interest rate risks – since the refinance happens often a year after the purchase, rates could go up.

Some of these risks are just that – risks. You need to prepare for them. What will you do if X,Y,Z risk occurs? What will be the actual effect of the risk coming up?

All too often new investors see a risk or hear the word risk and run away. But you need to lean into what the risk is and understand it first. Once you understand it, then you can decide to either take it on OR walk away from it.

No need to run.

With that being said, here are the different ways that the exit mortgage can be financed:

Purchase Plus Improvements

The purchase plus improvements mortgage is an interest product. It’s effectively a construction mortgage where there is only 1 draw.

Essentially the way it works is the lender approves the original mortgage based on the after repair cost of the property.

Note: After Repair Cost is the purchase value plus the cost of renovation.

They fund the purchase mortgage as normal, and hold back the remaining funds (effectively 80% of the renovation cost). Those funds are released when the renovation is complete.

The pros of this direction are:

- Get approved at the beginning of the strategy.

- Already know the rate, so there is no rate risk.

- Only have to qualify once

- No seasoning of the property

The main con of this direction is:

- You aren’t getting all of the equity out. Since you are using the After Repair Cost instead of the property value, you will not be taking out all of the equity.

Equity Take Out and Refinancing

There are 2 ways to restructure financing on a property:

- Equity Take Out

- Refinance

Equity Take Out vs Refinance

An Equity Take Out is when you get a new loan product behind your existing loan product. This can be useful for many reasons. 2 of the biggest are:

- if you have really good terms on your existing mortgage

- If you locked into a fixed rate and the penalty is large

A Refinance is when you completely replace the existing financing with new financing. This can often be easier to do. There are more lending options for refinancing than there are for an Equity Take Out.

Both of these directions can be done with conventional lending – both prime lending and sub prime lending.

Commercial or Small Business Financing

I left this as a separate financing section because it can be a key way to scale your property business. Especially with the BRRRR strategy.

Commercial financing and small business financing use completely different guidelines for qualification.

They often don’t use your personal income or number of properties in their guidelines.

This means scaling with them can be much easier.

The down side is that they are more pricey with higher rates, often fees, and usually shorter amortization periods.

The main benefit though is they don’t have a number of property limit so you can continue your business through time.

The other interesting thing they can do is what’s called an inter-alia mortgage or blanket mortgage. This is where they lend one mortgage over multiple properties. This has many use cases but I don’t want to dive into the deep end of commercial and small business financing right now.

What you should prepare for:

- You need to prepare to hold the property for a year to season. Some lenders will allow you to refinance earlier BUT it’s on an exception basis. We’ve helped clients do this. It’s not guaranteed and it’s not always possible.

- There is a 5 property wall. This wall exists because of lender guidelines. It makes it tough to grow past 5 properties. That’s where planning comes in play. I always suggest put a plan in place early so you can avoid the wall in the first place.

- Expect the rates to be higher. You likely will have to wait for the refinance. Be prepared in case rates are higher than you expect.

- Have a back up exit strategy. Selling, or even holding without refinancing. You never know exactly where the market will be. Ask the question: What if the worst case scenario occurs? What will you do?

What should you look for in a BRRRR Strategy?

When analyzing potential markets and deals for the BRRRR strategy there are 3 things necessary for success:

- Enough potential lift in property value

- Sufficient cash flow after the refinance

- Potential 2nd exit strategy – just in case

Raise in Property Value

To get all of your funds back you need the property value to go up enough that 80% of the new value is equal to the the sum of original cash and financing. Big word spaghetti there.

The cash put in + original financing + reno costs = 80% of the after renovation value

Said another way, you need to look for a property where:

After Reno Value = (Cash + Financing + Reno Cost) / 0.8

Post Renovation Cash Flow

Check what the after reno mortgage would look like for payments. Add that to your expenses and check that number against your potential rental income.

If you need cash flow from your investment or at least you need to be cash flow neutral, double check this number.

Having extra cash flow will help with financing your renovation by the way. You should aim to always have positive cash flow so you don’t get stuck with bad financing.

2nd Exit Strategy

Not going to beat a dead horse here. Plan for the worst, hope for the best.

If things go south, can you sell the property? Can you keep the property un-refinanced? What other options exist for a 2nd exit plan?

Summary of the BRRRR Strategy

We went over a lot here. We talked about:

- What the BRRRR Strategy is

- The Pros and Cons of the BRRR Strategy

- The main considerations you need to make when planning the BRRRR Strategy

- How to finance each stage of the BRRRR Strategy

- And lastly, What should you look for in your BRRRR Strategy

You may have other questions or want to chat about specifics. If that’s the case, I’m happy to help.