When you talk to a financial advisor, investor, or most other individuals who invest, they will tell you about their investments in terms of “returns”.

This is both right and wrong.

It’s important to distinguish not just the returns, but also what do those returns actually mean to you.

First off… disclaimer (of course): this is not intended to be financial advise. Seek a professional before making decisions.

What is a Return on Investment? (ROI)

The return on investment is the percent of how much excess you make from investing over how much was invested.

Typically this number is an annual measure.

It’s calculated as:

ROI (y/y) = $ returned per year / $ invested

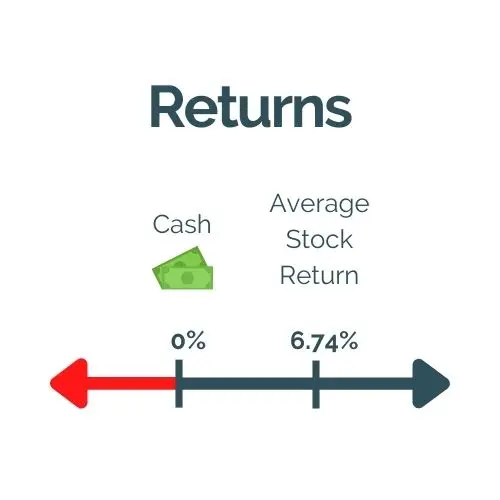

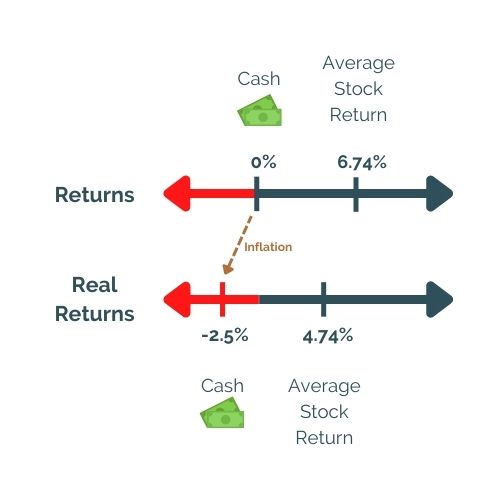

To give you some context, the long term average of the over all stock market is about 6.74% (excerpt)

This means for every $1,000 you invest, you would get $67.40 in returns per year.

Cash on the other hand gives you 0% returns because it is our baseline.

Inflation is like friction… but what is inflation anyways?

That brings us to inflation.

Inflation is effectively a drag on money.

It is the average increase of prices in things you buy.

If you have $100 but next year everything goes up in price by $2, your $100 will be worth $2 less than it did before.Now, there’s a TL;DR version here OR if you’re a nerd like me, there’s the longer version here.

TL;DR: Why should you care about inflation

The Bank of Canada and other central bankers around the world want inflation to be between 2-3% per year. Meaning your money loses 2-3% of value every year.

Long version – Why should you care about inflation

You know how when you go to the grocery store, you pick up a basket to start putting your food in?

By the end of your grocery trip you would have put a whole bunch of different foods in. If you planned correctly, you’d have the right amounts of each item to last you for the next few weeks.

This basket would have come out to a certain amount of money but it also would have been what you’d expect to live off of.

If a few of those items went up in price while a few went down in price, you may not notice the change at the register.

On the other hand, say you eat a lot of meat. Meat makes up a large portion of your grocery budget. If meat prices went up, you likely would feel a big difference in how much you spend. Even if prices of other items like bread went down, because the percent of your budget for meat is larger, you would have to pay more.

This affects the cost of living for you.

CPI (or Consumer Price Index) attempts to measure this affect.

It asks, what is the weighted average of costs for a basked of things. It includes more than just food. It also has housing, transportation, utilities, and more.

When you hear people or the news talking about inflation they are really talking about CPI.

Real Returns a.k.a. Inflation Adjusted Returns

That was quite a bit…

Let’s bring all of this back to the real world and why we’re talking today.

You pull out your wallet… pretending you still carry cash… and pretending you have $100 bill… you pull out your $100 bill.

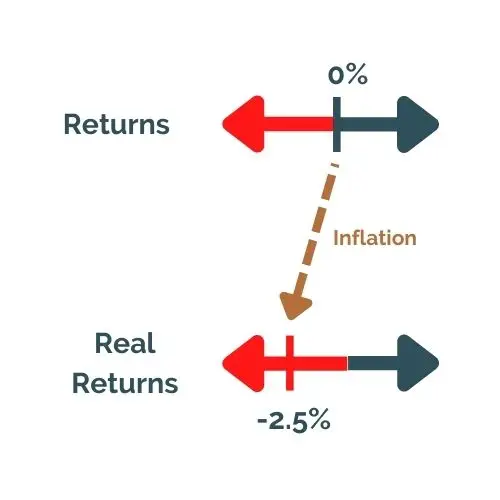

By the “nature” that the Bank of Canada creates, at the end of one full year, your $100 bill will be worth about 2.5% less than it does today. It would be worth about $97.50.

Now instead, you took that $100 and invested in the S&P 500 and received the average market return of 6.74%. This would mean that the S&P 500 would have paid you $6.74 for investing for a year. Great!

But hold on…

Now that $106.74 is worth less than how much it was worth a year ago…

Infact the it’s is worth 2.5% less.

The value of your money at the end of the year is $104.24 compared to last years $100.

This is called your real return on investment.

You can also call it your Inflation Adjusted Return on Investment (but noone really uses that)

The Real Return on Investment = ROI – Inflation Rate

How inflation and real returns affect you as an investor

As an investor, it’s important to know this because inflation is not the same, year after year.

It changes and fluctuates over time. For example, here are some of the inflation numbers in Canada:

- Oct 2021: 4.7%

- Jan 2022: 5.1%

- Aug 2022: 8.1%

- Sept 2022: 6.9%

(Keep in mind that 2022 was post COVID and the Bank of Canada had to reign in inflation by adjusting rates. Very historic event)

Because of this fluctuation, you need to pay attention to not only your returns but ALSO the inflation rate.

If the average investment return of the S&P 500 is 6.74% as we discussed earlier, and if inflation is 2.5%, then the Real Return is 4.24%.

If however, we can get the same return but inflation is the same as September 2022 at 6.9%, then we are actually at a loss in Real Returns at -0.16%.

Now, to see a positive Real Return, we would need to find an investment that gives us a higher return.

Ok great, so just find the highest Real Return? (NO!)

Not so fast!

The higher return you look for, typically the higher the risk of losing your money there is.

Real return is one piece of the puzzle to think about before you put your money into the market. You also have to think about risks. Real returns acts as a great mental framework to start thinking about what to invest in.